Merry Christmas and Happy New Year from the Revolution Partners.

Realize

Revolution Partners and ATA Join Forces for Wealth Management

Registered Investment Advisor, Revolution Partners, LLC and Alexander Thompson Arnold, PLLC (ATA), one of the region’s largest accounting firms, have completed the registration process to formalize a business alliance under the name RPATA, LLC. The RPATA partnership will allow professionals in both organizations to communicate directly on behalf of their clients, leverage shared information and technology resources, and deliver more convenient, consistent and collaborative wealth management services to families, business owners and professionals.

A note from CEO Brian Fowler on the single passion of his professional life (hint: it's not pickles)

My wife and children gave me a pickle crock for Father’s Day. It’s a cool gift, and it was very thoughtful. I’m a frustrated gardener, I love to cook, and I can’t help but be intrigued with all the possibilities of pickling. I was excited.

On the evening of June 21, in jest, I posted on Facebook, “We’re launching a new brand of pickles in three weeks – invitation only!” The replies started to hit immediately.

A note from our ever-industrious and resourceful CFO, John Moss

This year, I celebrate 40 years in the financial services profession. I’d like to share some reflections with you. First, a few numbers.

We Run a Tight Ship: Paying attention to asset allocation, expenses and taxes

Revolution Partners strives to construct well-diversified portfolios with a measured approach to investment selection. We believe portfolios with a high number of funds come with additional hazards; for example, it may be challenging for an advisor to effectively monitor each investment on an ongoing basis, and the often accompanying higher turnover in these portfolios typically results in additional trading and tax costs.

All Will Be Revealed: Is your portfolio too complex and expensive?

In a recent discovery review, we found a new client’s existing investment portfolio allocated among 20 actively managed mutual funds from three well-known fund companies. The average expense ratio of these funds was close to 1.00%, meaning before performance and advisory fees are even taken into account, the client was giving up at least one percent of his assets annually to mutual fund expenses.

By our standards, this portfolio was too complex and too expensive. But why?

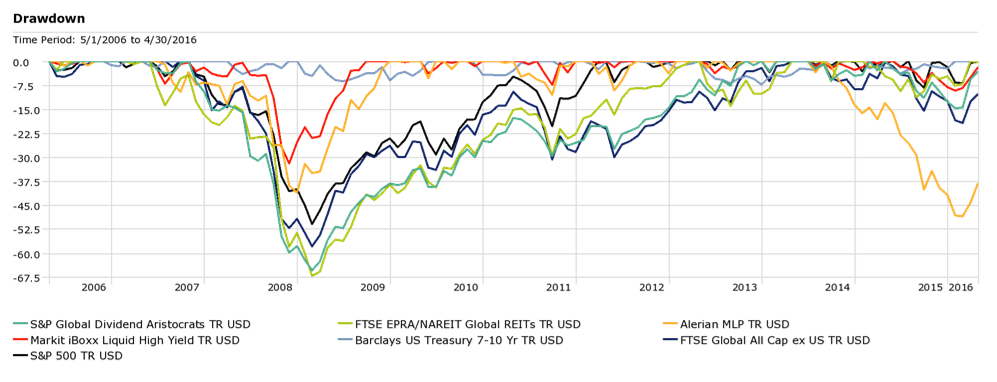

Know What You Own: Mid-2016 market commentary and analysis

The first half of 2016 has been anything but reassuring for investors. Depressing global growth prospects and tumbling oil prices earlier this year provoked panicked investors to dump their stocks in droves, resulting in significant declines in the major U.S. stock market indexes.

Between the start of 2016 and February 11, the Dow fell nearly 10%. Oil prices bottomed on February 11 and stock prices followed, bringing U.S. equities back into positive territory.

While we were lucky to see a swift reversal of the second market correction in less than a year, we must remember that not all recoveries happen so quickly.

If any of your investments gave you excessive heartburn during the first part of 2016, now may be the time to reevaluate your portfolio holdings and sell the investments that declined more than expected, before we experience the next correction.

Fair Labor Standards Act News: The "new math" for business owners

Analysis from CFO John Moss

Here’s some time-sensitive news for all of our entrepreneurs, small business owners and employers:

In May 2016, the Department of Labor (DOL) released regulations modifying the Fair Labor Standards Act (FLSA) requirements.