The first half of 2016 has been anything but reassuring for investors. Depressing global growth prospects and tumbling oil prices earlier this year provoked panicked investors to dump their stocks in droves, resulting in significant declines in the major U.S. stock market indexes.

Between the start of 2016 and February 11, the Dow fell nearly 10%. Oil prices bottomed on February 11 and stock prices followed, bringing U.S. equities back into positive territory.

While we were lucky to see a swift reversal of the second market correction in less than a year, we must remember that not all recoveries happen so quickly.

If any of your investments gave you excessive heartburn during the first part of 2016, now may be the time to reevaluate your portfolio holdings and sell the investments that declined more than expected, before we experience the next correction.

Our advice is particularly applicable to income-driven investors. The current low rate environment has been a major source of frustration for fixed income investors as interest rates have been at historic lows since late 2008. Quantitative easing has sent rates lower in developed markets around the globe, leaving investors with few options for low-risk sources of income. As global interest rates remain low and in some cases negative, investors have become more aggressive in their search for income, shifting their portfolios towards riskier investments such as dividend-yielding equities, REITs, MLPs, and high yield bonds.

Economists are quick to remind us that time alone does not end economic expansions. However, given uncertainty amid slowing global growth and relatively high equity valuations, we believe another market correction is well within the realm of possibility. Therefore, it is crucial that investors revisit their portfolio holdings now to ensure they understand exactly what they own. Certain high yielding investments may have a place within a diversified portfolio. However, when equities, REITs, MLPs, and high yield bonds are used as fixed income proxies, investors must remember that they do not behave like traditional fixed income when equity markets turn negative.

The table below compares the yields of four popular, relatively high-yielding ETFs to an intermediate Treasury bond ETF.

|

Index |

Ticker |

30-Day SEC Yield* |

|

SPDR S&P Global Dividend ETF |

WDIV |

4.31% |

|

iShares Global REIT ETF |

REET |

3.52% |

|

Alerian MLP ETF |

AMLP |

6.84% |

|

iShares iBoxx $ High Yield Corporate Bond ETF |

HYG |

6.61% |

|

iShares 7-10 Year Treasury Bond ETF |

IEF |

1.59% |

*Most recently reported data, either 5/18/2016 or 4/29/2016

Based on yield alone, government bonds have been a relatively unattractive investment for some time. Morningstar fund flow data reveal that over the last five calendar years, the Intermediate-Term Government Bond category has experienced net outflows of $28.5 billion. Over the same time period, U.S. Real Estate funds had net inflows of $34 billion, Global Real Estate funds had net inflows of $20.5 billion, MLP funds had net inflows of nearly $45 billion, and High Yield Bond funds had net inflows of over $38 billion. When markets eventually turn, investors who have poured their money into these relatively high-yielding funds may see their portfolio values fall more than they expected.

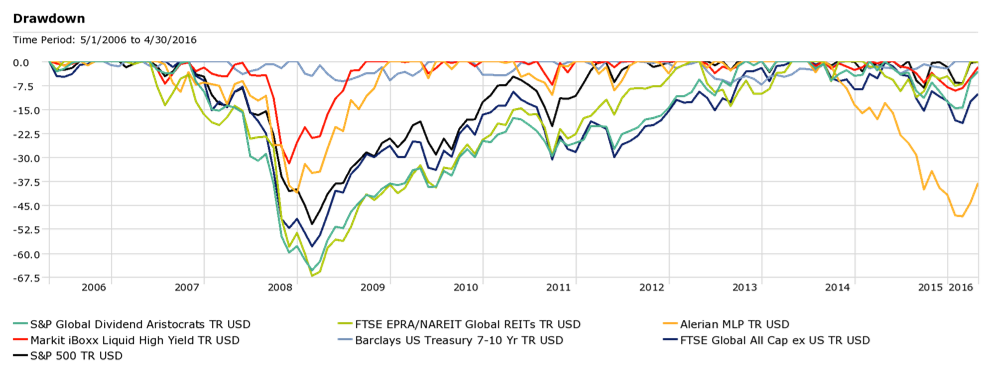

The following chart illustrates how these asset classes tend to behave relative to U.S. and non-U.S. equity markets. MLPs experienced a sharp drawdown beginning late 2014 into early 2016 when energy markets collapsed. When U.S. equity markets corrected in 2011, Treasury bonds were the only asset class of this group that provided a safe haven. And, when global equity markets completely melted down in 2008, MLPs and high yield bonds provided little protection while dividend-oriented equities and REITs underperformed global equities.

Source: Morningstar Direct

Regardless of what these investments are yielding at any given time, based on their historical performance patterns, we expect asset classes that are highly correlated with equities to perform poorly in an equity market correction. Investors who are unsure of what they own or who know that they have exceeded their risk budget in the search for income should take this opportunity to reexamine their portfolios. The start of 2016 was a good example of the panic that can be felt when portfolios are more sensitive to equity markets than they should be. We urge investors to make adjustments now so that you can have peace of mind when equity markets turn negative.

Revolution Partners has the tools and resources necessary for this type of portfolio analysis, and we have already taken this step for our clients. If you have any questions about your portfolio holdings, we would be happy to talk with you.