Working Together

for Your Life's WorthTM

Our Next Meeting

How to Prepare

- Accept your Box invitation.

- Gather your essential documents to share with us. Bring those to the meeting or upload those to Box.

- Decide how to share your financial account information with us: statements or online.

What to Expect

Together, we will collaborate at your home, our local office, or other business to:

- Upload important financial data and documents to your electronic lockbox and Client Portal.

- Discuss Your Life's Worth(TM) and review your financial goals and dreams.

What is Next

The team gets to work. While you may initially interact with one or two team members, we all work together to:

- Organize, review, and your important documents.

- Analyze your existing financial accounts.

- Draft a plan for your goals.

- Prepare and present our recommendations for you.

How to Prepare: Essential Documents

Depending on how you engage with us, we may request a variety of documents and information. The more we know, the more we can help you achieve your goals and plan for the future.

Investments

To begin analyzing your overall investment situation and needs, at a minimum, we need these documents:

- Investment statements

- Bank account statements or balances

- Retirement plan statements and plan descriptions

Basic Planning

To work on a financial plan for you, at a minimum, we need the following:

- Immediate family information with formal names and dates of birth

- Total monthly or annual income: Income sources and estimated annual income by person

- Total monthly expenses

- List of current liabilities

- List of current assets (bank accounts, investment accounts, retirement accounts)

- Private investments

Essentials

Your documents should align with your goals, account structures and account titles:

Tax and Estate Documents

- Wills and trust documents

- Powers of attorney and living will

- Last two years of personal income tax returns

- Gift tax returns

- Private foundation documents

Insurance Documents

We don't sell insurance, regardless it is important to know if your coverage matches your needs.

- Life insurance

- Disability Insurance

Employment Documents

- Employment contracts

- Description of personal and professional business and/or partnership interests

What to expect: Collaborative Meeting

This is all about your life, your goals, your work and your family. We will also review your finances and take inventory, and then use what we've learned to begin our thorough analysis.

What is Next: Team Work

You spent the time and energy getting your information and documents together for us, now it's our turn to work for you.

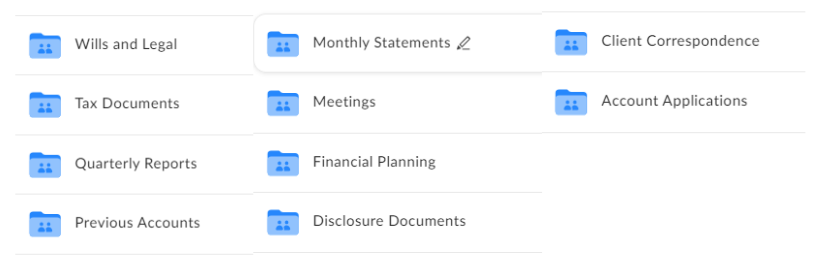

Revolution Partners + Box.com

Revolution Partners has teamed up with Box.com, a cloud-based file storage company, to provide you and your household with an online document lockbox to store and conveniently access your important financial documents securely.

Your Revolution Partners team administers the service and uses the tool to deliver account-related documents and paperwork. You can co-manage the documents and folders, upload documents to share with Revolution Partners, and we can help you designate a CPA, Lawyer, or other trusted person to have access to a single document or to a folder as needed.

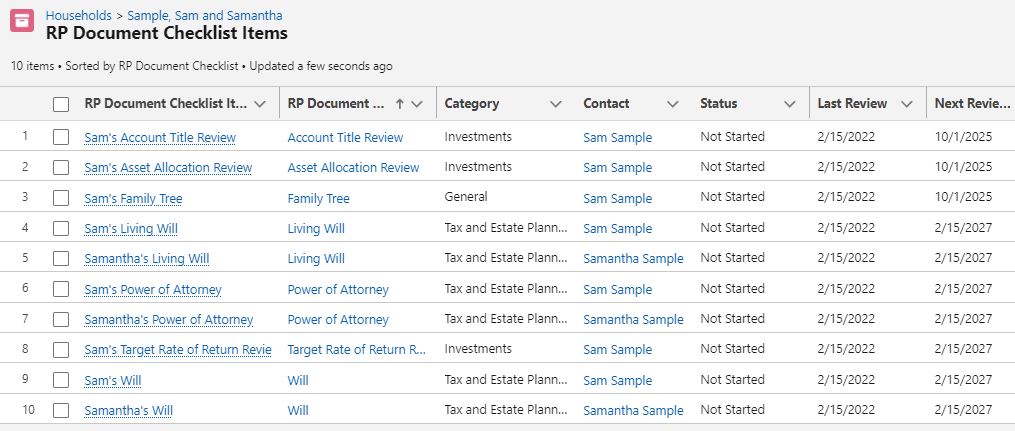

Helping Your Documents Stay Relevant

Has it been more than three years since you reviewed your essential legal documents, insurance coverage, account titles, and beneficiaries?

We review your important documents, capture the basic information, and put each document on an applicable review schedule.

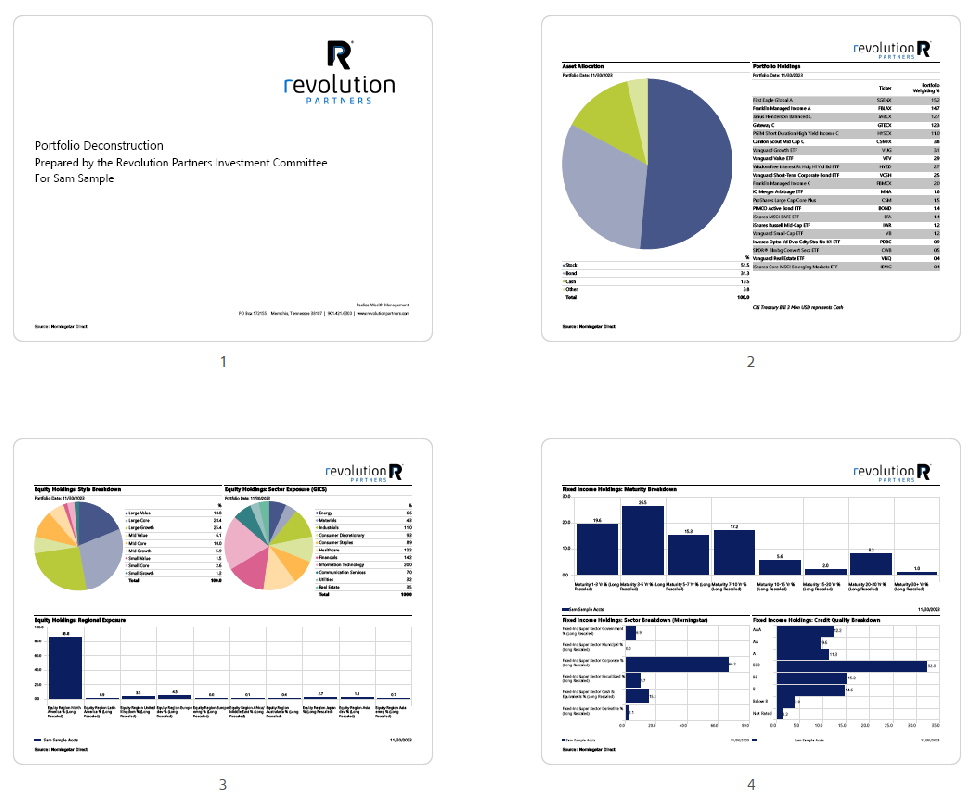

Determine if Your Portfolio is too Complex

Asset allocation, the mix of investments an investor owns, typically accounts for the majority of a portfolio’s return level.

Some advisors make the mistake of believing that client portfolios are more diversified, and in theory less risky, with each additional fund they hold, but where is the strategy? Managing a plan to meet investor goals is even further complicated when clients work with more than one financial advisor.

Identifying and removing the clutter, we know that you can properly construct a well-diversified portfolio with only four or five complementary investments.

Live Your Life's Worth(TM)

There are five main reasons to have a financial plan:

- Know Your Required Rate of Return

- Consider the Tax Location of Your Savings

- Quantify All Your Money Goals

- Prepare for the Unexpected

- Plan Your Legacy

What's Next

When the review and analysis of your existing situation are complete, we will walk through our consolidated findings and suggested course of action together.

Review and Maintain the Documents

The headline and subheader tells us what you're offering, and the form header closes the deal. Over here you can explain why your offer is so great it's worth filling out a form for.

Remember:

- Bullets are great

- For spelling out benefits and

- Turning visitors into leads.